The Many Layers of FTX, Alameda and Sam Bankman-Fried's Failure

The obvious villains are SBF and the crooks who perpetrated this scam, but they had plenty of help

(Photo credit: @netcapgirl)

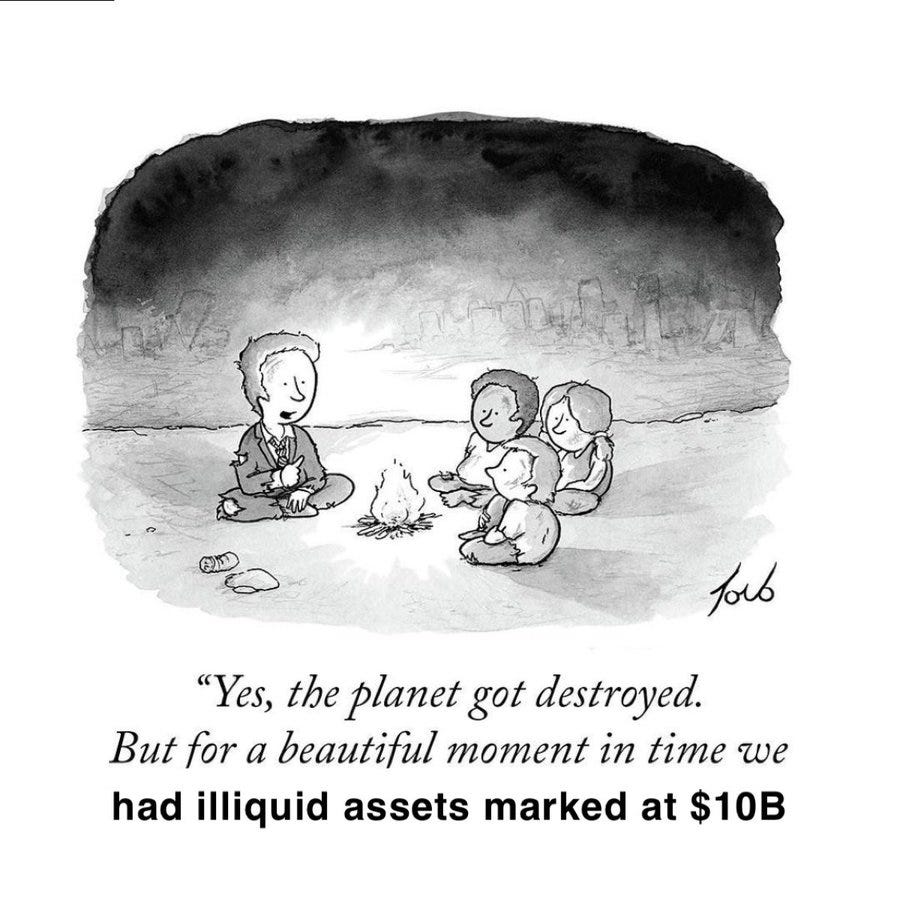

I feel like I already wrote this article in a sense, but FTX, Sam Bankman-Fried, and Alameda have forced my hand yet again. My last piece on crypto fraud was about the LUNA fiasco that robbed millions of dollars from retail participants, so it’s a bit somber but unexpected that my next one is about an even bigger Ponzi scheme aimed at retail—one who got hit in the LUNA blowup but because of their “unique” advantages, was able to mask it until the reaper came for their shitcoin and thus their entire business model. I made a meme to tl;dr the whole situation (everything in it is 100% true), but I’ll expand a bit on the basics of the case below before gettin to the paddlins.

FTX was run by Sam Bankman-Fried (SBF), and Alameda was its gigantic trading shop run by Caroline Ellison. There was supposed to be a meaningful firewall between them, but there wasn’t, and SBF plugged the holes in Alameda’s balance sheet using customer funds from FTX. In an interview crime against journalism with SBF that I’ll get to in a minute, the FTX figurehead claimed that he used customer deposits to recently pay off loans he took out against his heavily leveraged empire, but tracing FTX and Alameda’s activity on the blockchain suggests he was stealing customer funds far earlier than he admits (he also essentially admitted later in an interview with Vox that this was a lie).

A couple weeks ago, Alameda’s balance sheet was leaked to CoinDesk revealing that its largest asset was $3.66 billion of unlocked FTT (FTX’s coin that SBF created). This amount was equivalent to the entire market cap of FTT at the time, so crypto giant Changpeng Zhao (CZ) announced that Binance (the largest exchange in the world) would be selling $500 million worth of their FTT holdings to derisk out of this obviously insolvent institution—market panic ensued—and everyone sold everything they could to raise cash as the entire world went to hell around them. A hacker, likely a high-level insider, subsequently stole about $300 million from FTX in the wake of all this chaos, in a dramatic high-speed chase for all the world to see on the hacker’s etherscan page.

This is crypto’s lowest moment, and there are a lot of authors behind it. We’ll start off with one of the more shameless ones.

The New York Times

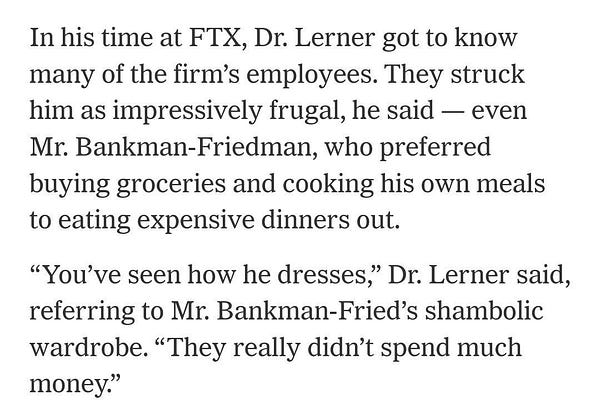

They were the first to speak with SBF after his scheme blew up, and they produced an article that should be taught in schools forever that highlights the scourge of access journalism. This was not a journalist demanding an explanation from the head of a pretty obviously criminal enterprise, but a stenographer there to let the criminal write his story for him. There was no mention of the sketchy on-chain data between FTX and Alameda, or the Reuters report about the the bookkeeping “back door” set up by SBF, nor was there even a quote from the litany of high-profile critics of FTX back in 2019. None of these facts were hard to find and yet none of them made their way into the (supposed) most prestigious journalistic institution in the world who very clearly believes that The Truth™ does not exist unless they report it themselves, which is a problem since much of their reporting is so consistently shoddy.

These two were central players in 3 Arrows Capital (3AC), another major fund scammer who blew up in the LUNA mess. It would be normal journalistic practice to talk to some of FTX’s biggest clients when writing a story about their fraudulent scheme. Instead, The Times got on hold with the most wanted man in the world who stole BILLIONS and there were no counterpoints raised about his pretty obvious Ponzi scheme in the “report,” but at least we got to know that he sucks at video games (credit to AOC’s social media team for this Twitter fatality at least).

David Yaffe-Bellany and his editors should be ashamed of themselves. This interview could only exist in a world where access journalism supersedes actual journalism. SBF clearly only agreed to it if he could tell his story lie unimpeded, and the New York Times let him do it. That article is a microcosm of why the media is so reviled amongst most people in America, as they eschew basic journalistic principles in favor of letting the powerful launder their own narratives through the NYT’s dwindling credibility. If that wasn’t bad enough, the next day The Times decided to let an FTX employee try to rewrite objective reality.

Contrast the NYT’s coverage of SBF’s supposed simple business mistake to how the bankruptcy manager has described FTX’s transparently fraudulent operation.

Before getting into the next failure I’d like to give a shout out to Bloomberg’s excellent journalist Matt Levine who is giving this scam the proper kind of exasperated scrutiny:

And then the basic question is, how bad is the mismatch. Like, $16 billion of dollar liabilities and $16 billion of liquid dollar-denominated assets? Sure, great. $16 billion of dollar liabilities and $16 billion worth of Bitcoin assets? Not ideal, incredibly risky, but in some broad sense understandable. $16 billion of dollar liabilities and assets consisting entirely of some magic beans that you bought in the market for $16 billion? Very bad. $16 billion of dollar liabilities and assets consisting mostly of some magic beans that you invented yourself and acquired for zero dollars? WHAT? Never mind the valuation of the beans; where did the money go? What happened to the $16 billion? Spending $5 billion of customer money on Serum would have been horrible, but FTX didn’t do that, and couldn’t have, because there wasn’t $5 billion of Serum available to buy. FTX shot its customer money into some still-unexplained reaches of the astral plane and was like “well we do have $5 billion of this Serum token we made up, that’s something?” No it isn’t!

Now compare that to how The Washington Post lamented how SBF won’t be able to fund pandemic research with customer deposits anymore. Journalism is dead, and stenography for the rich and powerful is the name of most of the mainstream media game.

Mainstream Media and Major Capital

People were calling BS on this scheme back in 2019! Where was the scrutiny as to where the nonstop money fountain for Tom Brady and the Miami Heat and Larry David and Robinhood and the Democratic and Republican Parties was coming from? The popular conception of crypto is that it is 100% fraud anyway, so why the hell didn’t anyone in any position of power anywhere ask any questions about FTX as they were purchasing their way into the mainstream consciousness? It’s just astonishing that everyone looked the other way on a scheme that advertised “high returns, no risk.”

This widespread failure to do even the most basic due dilligence on FTX says a lot about our fundamentally broken culture that worships money above all else.

There were plenty of people in crypto who doubted FTX from the start, and if mainstream journalism didn’t treat it as some sideshow run entirely by unserious people (there are a lot of unserious people in crypto though), eventually someone would have stumbled into the 3AC guys and transformed their tweets into The Truth™ and alerted Tom Brady, the Miami Heat and the entire Beltway establishment what they were getting into.

You can’t treat crypto like some irrelevant circus but also put it on the front of your basketball arenas in two of America’s largest cities while ex-presidents, ex-prime ministers and mainstream journalists attend symposiums run by FTX. Either it’s worth scrutinizing just like anything else or it’s a sideshow. Mainstream journalism has produced countless half-baked takes and shoddy reports about crypto, yet they never found their way into literally the largest scam in crypto’s history.

That’s a massive failure on their part. They looked for fraud everywhere except for the one filling their own pockets. Mainstream media and major capital proved themselves to be astonishingly incurious as to what they were looking at so long as line make boing and number go up, and a lot of innocent people paid the price for this greedy failure by seemingly everyone in a position of power around the FTX story.

Government Regulators

If the SEC had approved a spot Bitcoin ETF, then maybe the Grayscale Bitcoin Trust (GBTC) trade doesn’t come to create an entire industry of frauds. Funds like 3AC and FTX took advantage of the price difference in regular spot Bitcoin markets and what GBTC charged, and arbitraged entire leveraged empires on this inefficient market by design.

If people had a trustworthy way to invest in Bitcoin and Ethereum, then maybe retail never finds their way over to LUNA, Celsius, FTX and the litany of other centralized Ponzi schemes in crypto. Maybe they just put some spot BTC and ETH ETFs in their 401ks and forget all about it instead of traversing the wild west that regulators have helped create by dragging their feet. Approving a futures Bitcoin ETF only benefited speculators.

This halfway home that crypto exists in between regulated and unregulated is untenable, and keeping it in limbo helps perpetuate this cycle of fraud. SBF running around freely tweeting like a madman while regulators in Washington sit on their hands as retail loses millions is a perfect metaphor for who financial regulations typically benefit the most.

There will be crypto regulations coming next year, likely on things like “if you say something is $1 legally we’re making sure it’s redeemable for $1,” and “you can’t collateralize an entire empire with a shitcoin you created out of thin air.” The question is whether they will actually be effective enough to protect American consumers without completely destroying crypto.

Despite what our American-centric discourse believes about cryptocurrency, there are actual use cases for its democratizing potential, and we shouldn’t give up on the tech just because a lack of regulations in the West allowed a fake economy to leverage itself upon a tower of Ponzis. Ask an Argentinian about crypto and you will get a very different answer than if you ask an American about it. This space has real potential that grows more attainable with each cycle—we just need regulators to devise a set of rules that can limit its scope to do broader financial damage while aiding the actual utility of blockchains.

Crypto

The point of this piece isn’t to absolve crypto for their sins in this saga—I saved the best for last after all. The first people who should have called out this scheme are the ones most closely affected by it, and the entire space failed at doing their due dilligence. Even the 3AC guys above who said it was all one big fraud wound up getting scammed as one of the largest traders on FTX.

The FTX collapse is the culmination of the cultural failure of crypto over the last two bubbles, as it strayed from its hacktivist roots to a grotesque parody of the Israelites worshipping the golden calf in the desert. Gone was the ideal that decentralized financial applications should be used for the global good, and an obsession with leveraging them to make money took over.

This is crypto’s do or die moment.

LUNA was a black eye, FTX is a scar that will take a long time to heal, if it even does. If something like this ever happens again, that’s it. It’s over. No amount of government regulation can get the general public to trust this space with their money ever again. In fact, crypto should be welcoming regulation because right now it’s nearly impossible to see how major capital and retail money can ever meaningfully flow back into this space again without it.

Personally, as a crypto investor, I don’t expect new all time highs ever again without regulations in place (however, I do believe that Ponzis burning all the bullshit to the ground just so the space can rebuild under a clear regulatory framework just in time for the next Bitcoin halving to coincide with planned Fed easing in 2024-2025 is about as bullish of a setup for the next four-year cycle as it gets).

Crypto is hemmoraging value because so many betrayed its ideals. People who lectured others about the stone cold logic of “not your keys, not your coins” put entire treasuries on FTX in search of yields they would later find to be generated by themselves, and then they were taught a very expensive lesson in the dangers of centralization.

This is what hubris looks like.

Crypto is still one big testnet. No real-world utility has been proven at any serious scale outside of Bitcoin and stablecoins. Ethereum, the new darling of the space, isn’t even done with its 2.0 upgrade. Crypto culture is far too arrogant over an industry that is still mainly science experiments, fraud and vaporware (if crypto folks don’t believe me on the last charge, they’re welcome to peruse the plummeting retail volume from 2021 to now).

There are plenty of interesting ideas being developed in crypto, but despite all their utility to this small space, they are still more theory than product on the grand stage crypto aims to center itself upon. That’s OK. Just because ponzinomics made all of us think we were far wealthier than we actually are doesn’t mean there’s no progress being made in the space.

I’ve been interested in Bitcoin since 2014 and every cycle since has seen one great leap forward. In 2017 it was SegWit (correctly) sending BTC down the global asset path it finds itself on, along with Ethereum picking up on parts of Satoshi’s vision that Bitcoin had to abandon as its ideals were forced to compromise with reality. This past year was about smart contracts creating products you can actually use which was truly revelatory. In 2017 all we had were whitepapers and IOUs we got in return for ETH where most would inevitably go down 99% and then another 99%. DeFi summer 2020 was genuinely mind-blowing as all these ideas we had been reading about for years actually worked!

Anyone who says there isn’t progress being made isn’t paying attention.

The new problem crypto faces is that this cycle’s progress plus no regulation equals Ponzis as far as the eye can see. Money legos are extremely cool, but crypto must remember that they are just tools which can be used for good or bad, and their ease of creation and proliferation means that the harmful and useless money legos will far outnumber the productive ones in any unregulated environment.

Everyone in crypto needs to look themselves in the mirror and ask why they’re still here. The entire space just got destroyed by a trading shop who admitted they were in it for the volatility and not the tech, and their market manipulation was one of the central reasons why prices skyrocketed to the degree they did last year (it’s pretty clear that without FTX and Alameda’s scheme, crypto would not have experienced a second bounce to new all-time highs in the latter half of 2021).

The whole point of decentralization is that you don’t have to ask “what is that hoodied bean bag schmuck doing with my money?” The potential of crypto is far too powerful to waste on trite exercises like speculating on useless shitcoins whose only value is derived from YouTube’s exceedingly lax content moderation policies and hedge funds leveraged to the gills. It’s high time that crypto returned to its roots and focused on the utility of blockchains more than the price of its coins, or crypto as we idealize it will forever remain an EMSAM-induced fantasy.