If you don’t know who Will Stancil is, then congratulations on aggregating a healthier feed than seemingly 90% of Twitter leftists, because for those of us enmeshed in online socialist politics, this man is everywhere. Whether you like it or not as a lefty, you follow him because he is an interminably online person constantly fighting with other interminably online people on the left who will inevitably tumble into your feed, even if you have him blocked because screenshots are forever. Somehow, beyond all measures of objectivity and reason, he has found himself at the center of the online debate surrounding our economy and the recession that never came but is still felt by a majority of Americans.

For those who have not been paying close attention to economic specifics over the last few years, here’s a quick summary.

2020: Oh shit oh shit oh shit print money it doesn’t matter we’re all gonna die anyway

2021: Woah this money printing thing rules, let’s keep going, what can go wrong?

December 2021: Inflation Surged to Fastest Rate since 1982

2022: Oh shit oh shit oh shit jack up rates sell everything money is worthless now

Which brings us to 2023. Last year brought generational chaos to financial markets where the traditional 60/40 stocks/bonds portfolio that basically the entire planet is leveraged to the gills on was nuked straight to hell. Bonds are supposed to go up when stocks go down and vice versa, and the Fed hiking rates at the fastest pace in history across 2022 created chaos in markets that were due for a reckoning even before COVID created all sorts of shocks that are still rippling through the globe. America taking their stimulus checks and pumping dog coins and the Nasdaq to the moon created quite a bit of additional excess, and with all the turbulence across markets over a short period time, it felt like something was certain to break.

This is where the vibescession really began. People thought that office buildings were going to collapse the economy and the Fed was on the cusp of a historic 1929-esque policy error. The office building thing is still a looming existential economic threat due to its centrality to regional banking and the fact that COVID demolished the value of office spaces forever, but the doomers seem like they were wrong.

One of the most widely-predicted impending recessions in U.S. history became accepted as fact across the mainstream, and we all braced ourselves for 2023 when it did not quite materialize in 2022 (although if you factor out how the Biden administration refilling the Strategic Petroleum Reserve at the end of 2022 boosted GDP, there’s a case to be made that we did have two straight quarters of negative growth). The story of 2023 has been of a rapidly improving economy that the media has pretty much portrayed as the opposite all year. The vibes folks have a point.

One of the biggest problems in American politics and economics is the pure inadequacy of our major media institutions and their conscious refusal to call a spade a spade in service of marketing themselves as the chief arbiters of what they decide to be The Truth™ (along with their servile relationship with those in power). Spending the entire year calling an improving economy a bad economy surely had an effect on people’s perception of it, but how much? Stancil and his allies assert that “vibes” are the primary reason for the public’s poor perception of economic conditions, which is a really funny unprovable and irrefutable stance to take from a self-described data guy.

Claiming that someone misunderstands their own lived experience is a bold claim, and it’s one that you better have a lot of evidence of to make. Many traditional economic indicators like GDP growth do indicate a booming economy, and markets have responded. Right now, the Dow Jones is 2% away from its all-time high. On a macro scale, the United States very clearly came out of COVID better than our western peers, and a lot of that is a testament to the Biden administration’s willingness to actually invest in domestic growth. Despite what conservatives try to tell everyone at every turn, government spending can have a positive impact on the economy, especially when it gets spent in force multipliers like transportation.

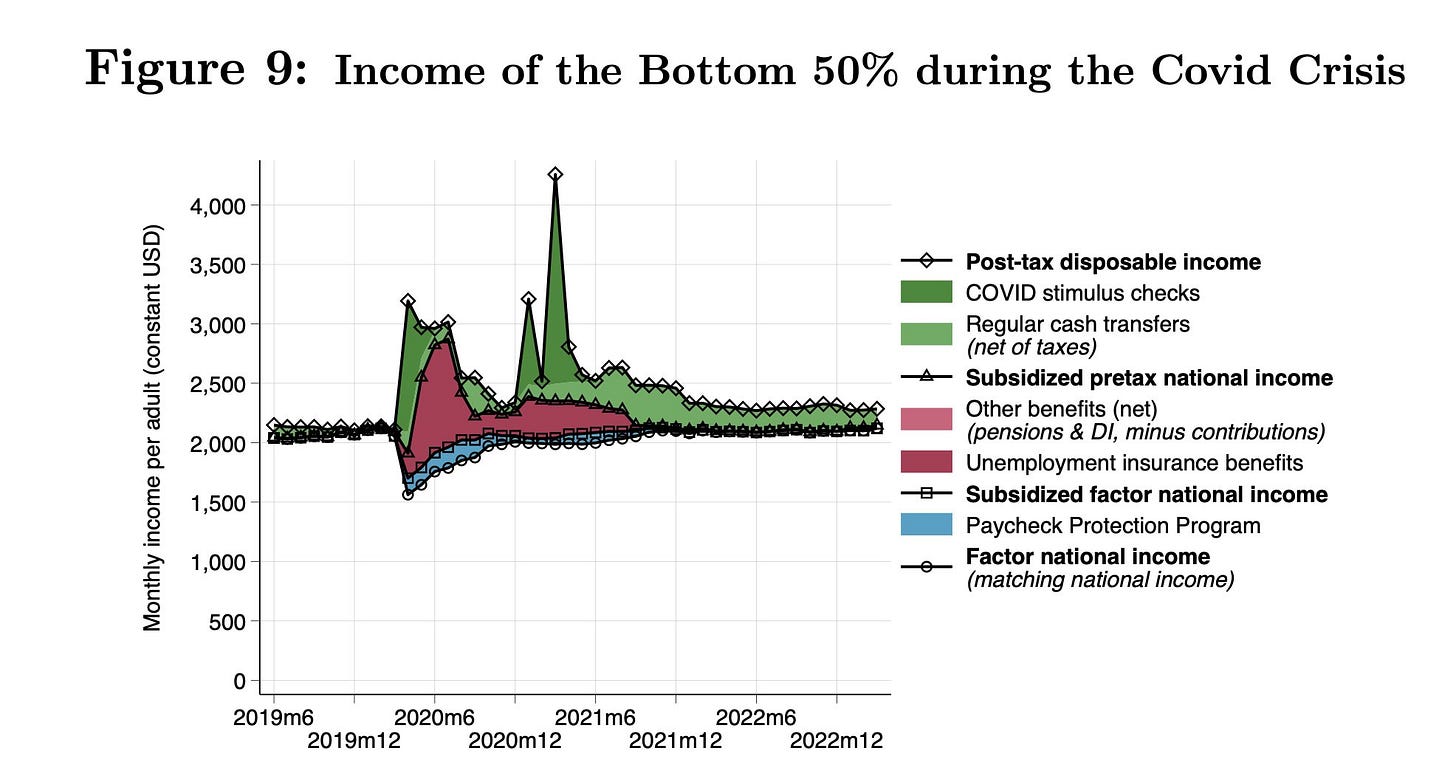

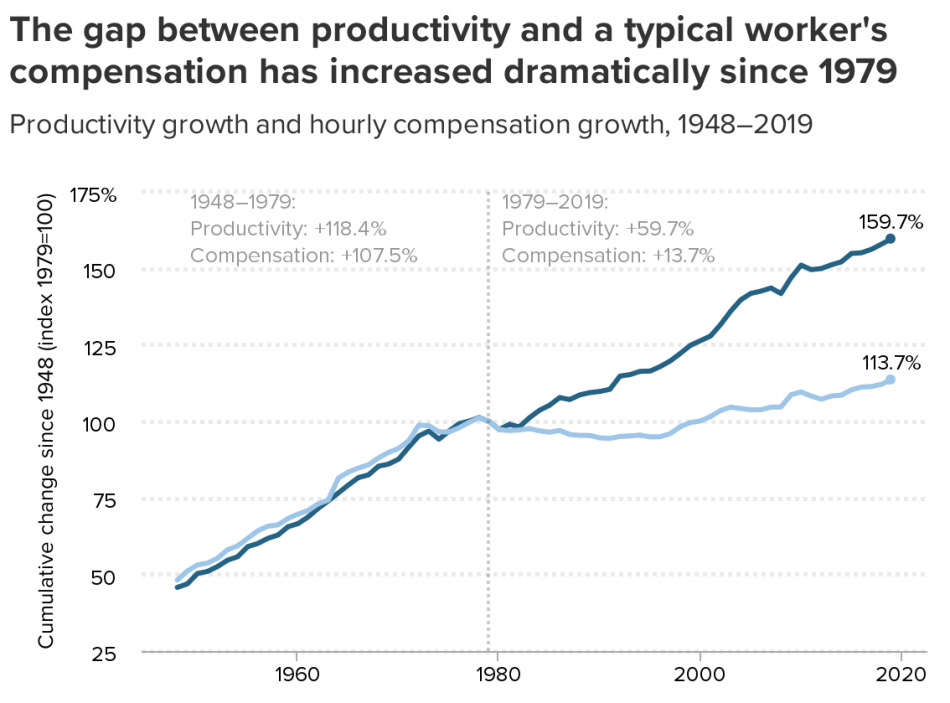

But the questions of whether the economy is good according to economic indicators versus people’s impression of current economic conditions are not the same. This is not the booming 1990s where a rising tide really did lift all boats (some much more than others, albeit), and the economy is as unequal as it has been in over a century. Characterizing the entire economy like the improvement of 2023 is happening in a vacuum outside of the macro conditions people have been living under for decades is a specious case at best. Nearly three-quarters of Americans believe the system we live under is unfair (and rising inequality makes them empirically correct in this belief), and most people do not own stocks or participate in a lot of the economic activities that have been boosted by the corporate profits-driven boom of 2023.

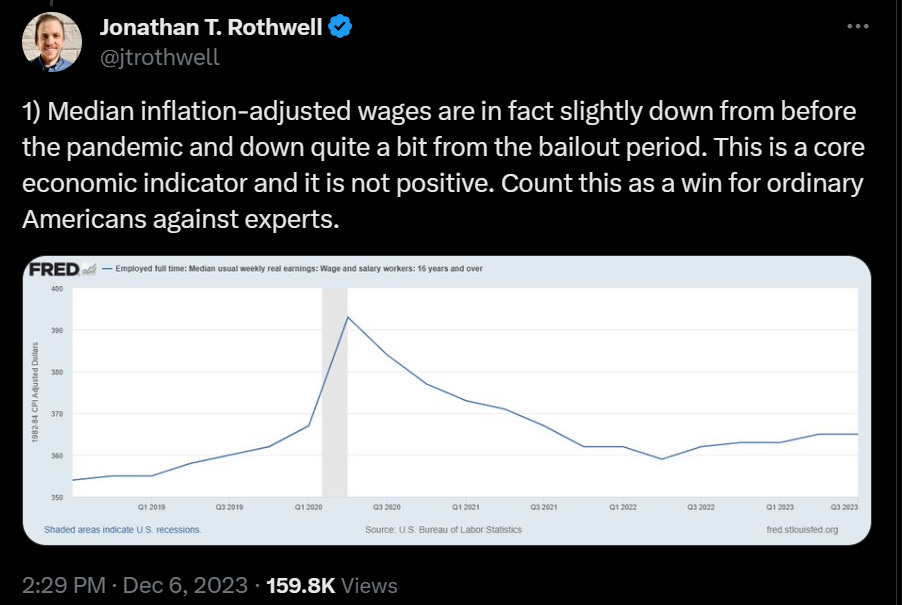

Sure, wages are up and inflation has come down, but inflation is still well above the Fed’s target of 2%, and combined with the Biden administration and their allies in Congress phasing out (historically successful) pandemic-era programs, people are feeling more squeezed despite wages improving. Asserting that they are misguided in this belief about their own lives doesn’t just make you a dick, it makes you wrong.

The economy is a wildly complicated machine, and just pointing to GDP or wages and saying “good” or “bad” is not a fully coherent economic analysis. There’s a lot of complexity that goes into an economy driven by consumer spending, and the fact that American capital has been taking more and more from labor while giving less and less back for (at least) half a century and counting informs people’s views a lot more than year-over-year changes in traditional economic indicators.

Plus, as all Americans have brutally learned over the past couple of years, the value of the denominator can change too, and that has as big of an impact on people’s economic livelihoods as anything. It’s pretty telling that if you search Stancil’s feed for “inflation,” all his tweets about it are how it influences people’s perceptions, and not, yannow, how it influences their budgets (this is because if he did this it would go against his unshakeable quasi-religious belief that there’s no there there).

Not to mention that a significant part of sticky inflation is higher corporate profits driven by prices pegged to a time when inflation was far higher (AKA corporate greed). This isn’t rose-emoji Twitter saying it, but the fucking Wall Street Journal. I wonder if that has any influence on people’s perception of whether the economy is helping them out or not.

This is a weird economic time. We have historic inequality, we’re coming off the highest inflation in 40 years with a rapidly growing economy (and a booming one on a relative basis to our peers), and people feel very pessimistic about the general state of things while a bunch of self-styled wonks yell at them for being wrong. I can’t believe I have to say this, but such is the state of 2023 Twitter discourse: people’s own lived experiences are more informative than Matt Yglesias and Will Stancil’s blogs and tweets.

Yes, the general populace can be misinformed about things all the time—particularly by a major media they simultaneously say they do not trust but also only get their news from—but their own economic lived experience is not one of them. Misunderstanding the nuances of politics or economics is very different from knowing how tight your own budget is—especially when compared to a wealthy untouchable class of people who have done better than anyone else since the pandemic. If anything, the people who believe GDP growth is a proxy for broader economic health are the ones who are naive and misinformed, as Michael Podhorzer, former political director of the AFL-CIO, wrote a couple weeks ago:

As I said on “The Ezra Klein Show,” the metrics that have long been used by political analysts to assess the economy – particularly GDP – are broken. While those measures reflected most people’s experience when rising tides lifted most boats, now those tides lift only yachts. As such, traditional economic metrics are unmoored from most people’s experience. This point was picked up widely on social media and then conclusively demonstrated in this New York Times guest essay by Karen Petrou with respect to GDP.2

The media can certainly influence the vibes around the economy, but they do not have the power to be the primary driver of perceptions like the Stancilytes assert. Capitalism is for capital, not for labor, and labor is becoming more aware of that each day. That kind of stuff informs people’s current economic perceptions a lot more than any charts that us nerds can throw at them.

All that said, please stop dunking on Will Stancil. I can’t take this anymore. I blocked him and I still see him everywhere. He is not this important. This is getting to Elon-levels of Twitter main characterism on the left.

Stand down, my fellow lefties. I’m begging you. I cannot read another one of this man’s bad tweets.